How Do People Make Decisions Under Uncertainty?

Tyrel Stokes

12:00, Friday, Feb. 14

BURN 1025

How much money should you save for retirement? Should you stay in academia or leave for industry or government? Should you try to finish your homework now or hang out with your friends and cram tomorrow?

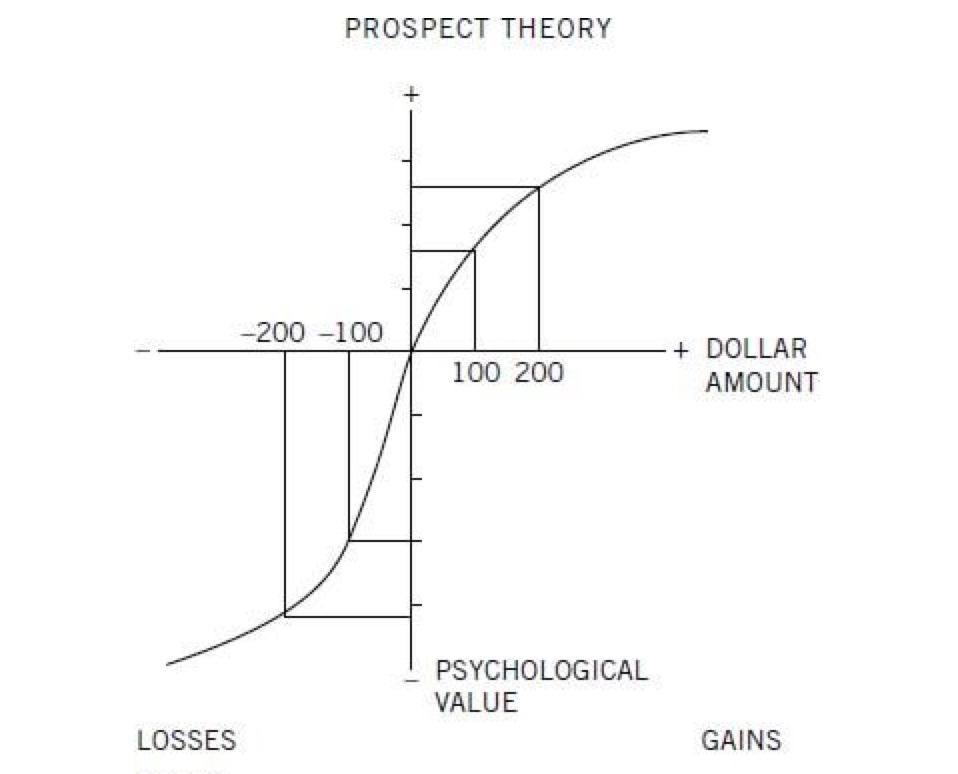

These are all decisions that we are forced to make (or put off, which is always one of our options) in today's world. The trick is that the optimal solutions depend on quantities or processes which are fundamentally uncertain, things which we have imperfect information about. For example, our decision of how much to save should probably depend on how much money we make over our lifetime. We can only guess maybe a distribution of what this might look like. Micro-economists, game-theorists, and decision theorists have developed frameworks for how one ought to approach these sorts of questions going back to Bernoulli in the early 18th century, however it wasn't until the late 20th century where we seriously examined where the utility theory fails in terms of generating predictions for how people actually behave.

In this talk I will talk about some of the basic results from utility theory for making uncertain decisions. From there we will explore the tension between optimal choices and observed choices in the real world. In particular I will give an overview of the key insights from "Prospect Theory" by Nobel laureate Dani Kahneman and close collaborator Amos Tversky and talk about the origins of behavioural economics as a subfield.

All graduate students are invited. As with all talks in the graduate student seminar, this talk will

be accessible to all graduate students in math and stats.

This seminar was made possible by funding from the McGill mathematics

and statistics department and PGSS.

back